Популярные статьи

Реклама

Обратная связь

Яндекс Апдейт

Сервис не доступен

Оцените работу движка

Кто онлайн

Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Yandex Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Всего: 132

У нас искали

Best Cryptocurrency Stocks For 2023 Bityard ▷ Passive Income Bitcoin-Trader

Best cryptocurrency stocks for 2023 bityard.

Scalping is one of the most profitable forms of crypto trading. It involves cashing in quick, small, and consistent profits, letting the compounded interest work out in your favor. Trading bots for scalping are software designed to initiate short intraday trades that can last anywhere from a few minutes to several hours.

It involves cashing in quick, small, and consistent profits, letting the compounded interest work out in your favor. Trading bots for scalping are software designed to initiate short intraday trades that can last anywhere from a few minutes to several hours.

If you're short on time and want to secure your gains in the crypto market, invest your money into the WunderFin platform. We'll give you up to $250 of free WUN tokens with our Referral Program, with no minimum investment required. You're guaranteed a good return on your money and the best crypto trading platform for scalping.

The key to long term investment success lies in the ability to create a properly diversified portfolio. The secret is to invest into the right asset classes and to ensure that you have the right distribution of risk in your portfolio.

Don't let the huge potential of compounding interest go to your head. You must stay disciplined and avoid the temptation to take all your gains now. Compound interest is a powerful force, but it can only take you so far. Discipline is what separates a successful investor from a portfolio of losses.

If you put these six proven small cap dividend stocks on your watchlist and reap the rewards of compound interest over time, your profitable portfolio will grow to a size that was only a distant dream before you started. Remember, the bigger your account grows, the greater your returns will be.

The chart below shows the compound interest earned and capital lost, on average, each year. The chart includes both interest earned and capital lost in the account balance. The capital lost includes the principal invested and all interest earned, as well as all dividends.

Discover how to begin a successful crypto trading strategy and begin making consistent profits today. Find out how to trade the crypto market at the right time and the right price with crypto trading strategies. Transform your investment into passive income today.

Best cryptocurrency stocks for 2023 bityard.

Fast Cash Oil-Profit _ Best cryptocurrency stocks for 2023 bityard.

Best Ripple Trading Platform in the UK.

Being among the top 10 cryptocurrencies by marketcap, Ripple (XRP) has high liquidity for trading and strong future potential growth. In this guide we review the best XRP trading platforms that accept UK and worldwide traders.

XRP is its native cryptocurrency of Ripple Labs, created to enable global payments. It has grown incredibly in market capitalization since its inception. It is sometimes referred to as just Ripple.

Technically Ripple refers to an XRP ledger, which is similar to the blockchain. It facilitates payments in XRP. Deriving its value from its digital payment network and protocol, it is a centralized platform, possesses global security and money transfer service. More than 100 companies have implemented Ripple’s software for smoother transactions.

All the Ripple coins that exist are pre-mined and there are around 45 billion XRP coins in circulation at the present. Ripple platform’s transactions are not limited to XRP but also facilitate fiat currencies like Dollars, Pound, Euro, etc, and other cryptocurrencies.

Best Places to Trade XRP in January 2023.

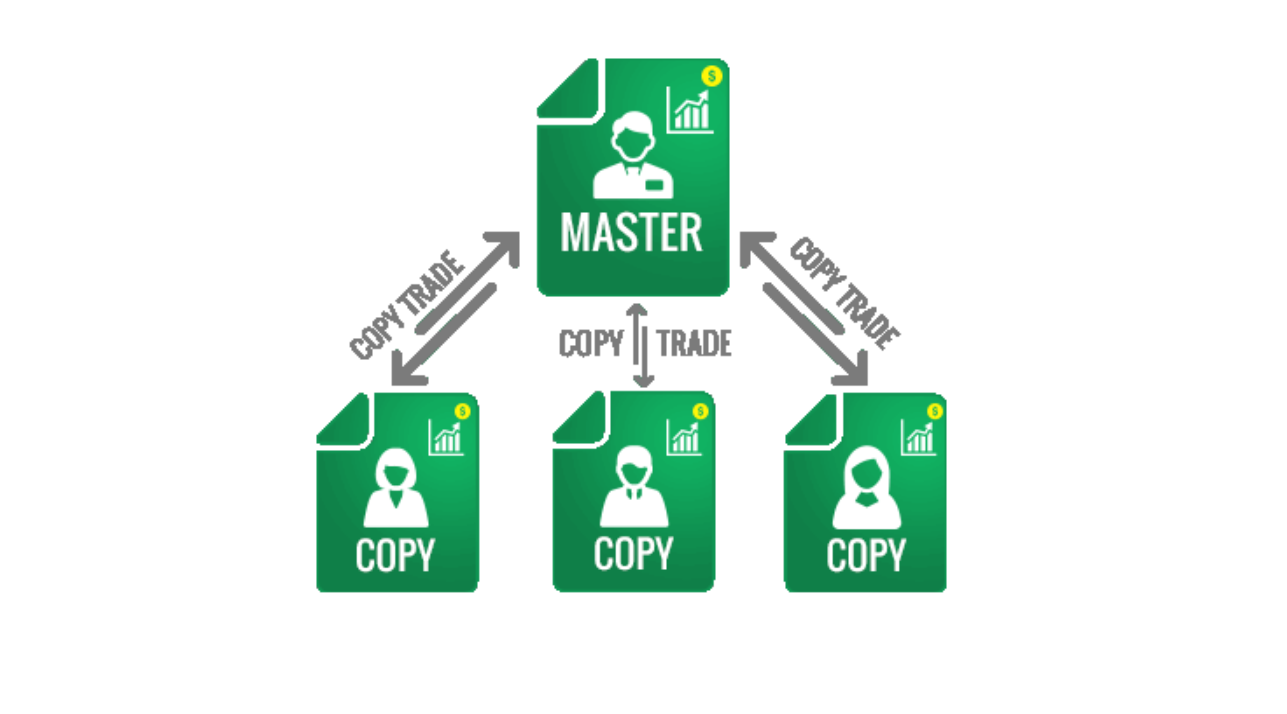

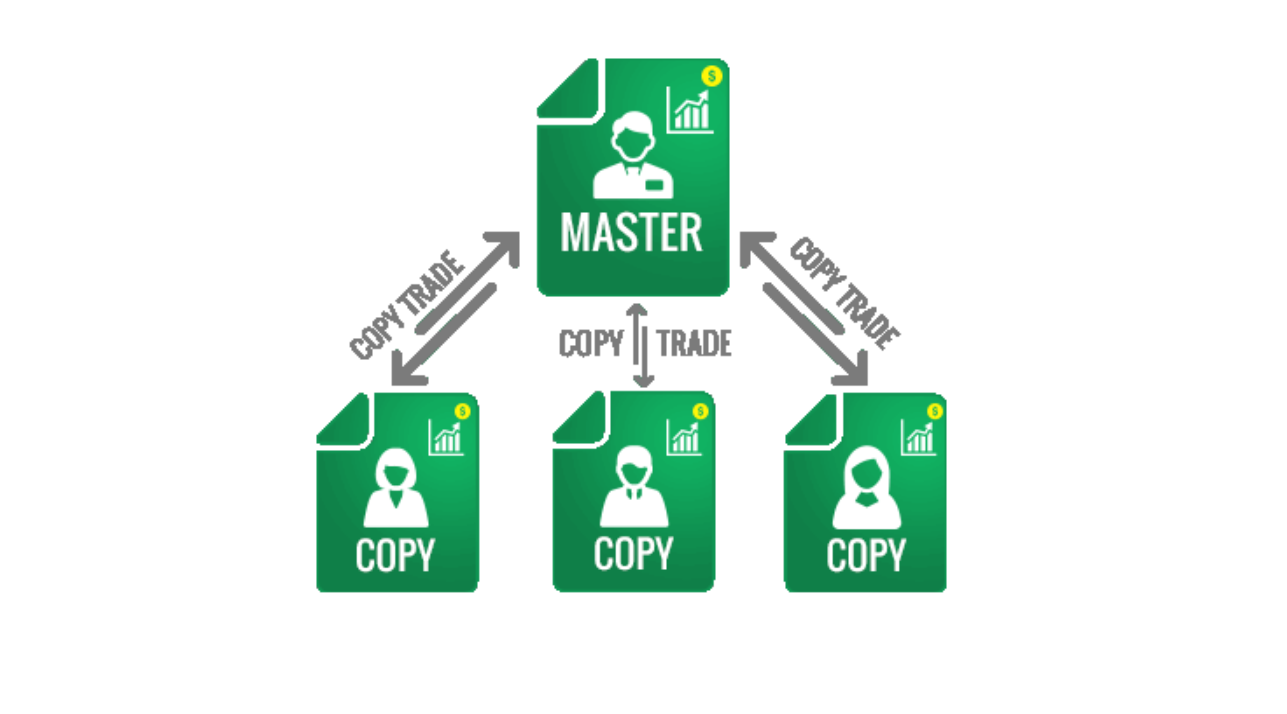

Copytrade winning investors.

XRP Trading Platforms in the UK – Top 5 List.

eToro – Best for copy trading others, and has solid regulation Binance – Best for a variety of altcoins Bybit – Best for day trading Kucoin – Best for small marketcap altcoins.

Best XRP Trading Platforms – Full Reviews.

eToro – Best Copy Trading Platform.

eToro stands out among the many crypto trading platforms on the market, and has listed XRP. As it is regulated by three institutions, it is also among the safest options available. The regulation licenses are from FCA, ASIC, and CySEC.

With 50+ popular cryptocurrencies listed for trading including XRP, eToro is a suitable platform for trading XRP. There are many pairs that eToro offers, enabling investors to leverage on the same. You can also benefit from crypto-to-crypto trades on eToro such as BTC/ XRP.

eToro offers outstanding tools like CopyPortfolios (also known as Smart Porfolios), enabling you to access a diversified range of digital currencies with solid portfolio management. The Copy Trading tool in eToro also allows you to copy the buys, sells and stop loss orders of expert traders.

The minimum deposit on the eToro platform is $10 for US and UK traders (about _7) and deposit methods include bank transfer, debit/ credit card transactions, e-wallets like Paypal, Skrill, etc.

Since many exchanges have suspended the markets for XRP, eToro remains one of your trusted platforms for trading XRP in the UK. It has an impressive customer support facility 24/ 5 available on chat, email, or on-call.

User-friendly, instant withdrawals Regulated by the FCA, ASIC, and CySEC Lower spreads compared to other platforms Offers crypto, stocks, indices, ETFs, and more Social trading, Copy trading and CopyPortfolio tools Supports fiat currency deposits Support debit / credit cards, Paypal, e-wallets.

2. Binance – Best Altcoin Exchange in UK.

Binance is another great option if you are looking for day trading Ripple. It has the highest daily trading volumes and liquidity. It is known to offer a huge number of trading pairs such as XRP/ ETH, BTC/ ETH, etc. Binance also facilitates the trade of a wide array of Altcoins on its platform. The technically advanced tools and indicators on the platforms enable day traders to trade profitably with Ripple.

It has the highest daily trading volumes and liquidity. It is known to offer a huge number of trading pairs such as XRP/ ETH, BTC/ ETH, etc. Binance also facilitates the trade of a wide array of Altcoins on its platform. The technically advanced tools and indicators on the platforms enable day traders to trade profitably with Ripple.

Binance exchange has outstanding security features to keep your crypto funds safe. The security process includes two-factor authentication, address whitelisting, email notifications, etc. Although it is an unregulated platform, it still ensures commendable safety and security. You can access the Binance platform on a desktop or use the iOS/ Android supported mobile wallet, and trading app.

The commission that the platform charges is 0.10% per trade. The KYC process is not required to make deposits using another cryptocurrency. It is mandatory only when you carry out bank transfers or debit/ credit card transactions for deposits. It has a charge of 3% for debit/ credit card transactions. eToro only charges 0.5% in this case. If you deposit funds by using a UK bank account, it is completely free.

Binance is known among traders for its sophisticated cryptocurrency instruments. You can go for copy traders crypto futures, options, and swaps. Unlike Bybit, it does not offer maker rebates in futures trading. If you use its custom cryptocurrency, BNB, or convert fiat currency to BNB, you get a discount. The platform offers 24/7 customer support on a ticket basis. It has options for retail and professional investor accounts.

Wide range of Altcoins Hundreds of pairs Advanced charting tools Customizable indicators on charts 0.10% trading fee Discount for using BNB Good security measures.

3. Bybit – Best Day Trading Platform.

Another reliable platform for trading Ripple in the UK is Bybit. The Dual Price Mechanism on Bybit exchange protects traders from trade/ price manipulation and helps in preventing losses. Traders can set stop-loss and derive profit at the same time when they go for a limit order. With sophisticated trading features, this platform offers up to 100x leverage.

With the leverage option, traders can opt for how to copy crypto traders a higher value without actually holding that amount. When you trade with "leveraging", you basically borrow from the platform to increase your bet. 100x leverage is an attractive feature, especially for experienced traders. By leveraging your trade with 100x, you have the potential of earning huge profits. In the case of high volatility, the feature will also incur losses even with a slight price dip. Hence, using such features demands caution.

Bybit comes with an in-built Tradingview, which has remarkable indicators so that you can engage in trading Ripple profitably. There are no charges for funding and it stands out as a platform that offers a 0.025% maker rebate for limit orders in futures trading. You can also go for quarterly futures contracts trading. With this feature, traders are able to use a calendar cycle to set contracts’ expiry, which adds up to the spot price.

Bybit does not directly handle fiat deposits. Users are able to deposit by using another cryptocurrency for trading. It has a 0.075% taker fee per order for futures trading and a 0.025% maker rebate. With a 0.10% trading fee for spot trading it is a competitive platform in terms of charges. Bybit XRP withdrawal charges are 0.25 XRP per withdrawal and the minimum withdrawal is 20 XRP.

You can access the Bybit platform on a desktop or its app supported on IOS and Android systems.

No KYC needed Up to 100x leverage Spot and contracts trading Enables quarterly futures contracts trading Maker rebate for trading contracts Available as a mobile app Multiple order types supported Reduced risk of liquidations.

4. KuCoin – Best Low Marketcap Altcoin Exchange.

KuCoin can be used conveniently for trading Ripple in the UK. By supporting around 200 cryptocurrencies, it is a preferred name among investors.

Being in the highly competitive crypto market, this relatively new crypto exchange enables futures and margin trading with up to 100x leverage. It is known in the market for having a well-structured trading platform. It offers a high volume of liquidity. The number of assets and services on this platform is huge and it is now a highly opted platform among seasoned crypto traders.

Many investors who are seeking a variety in terms of coins go for KuCoin. If you trade Ripple on this platform, you can hugely benefit from more than 300 different trading pairs that it offers.

Buying XRP on the platform is possible with P2P fiat trade, credit/ debit cards via Simplex, PayMIR, Banxa, etc. If you want to trade small market-cap coins apart from your Ripple investment, then this is the best platform available for you. It also offers bonuses and discounts.

KuCoin has a 0.1% charge per trade. The charges are relatively lower for futures trading. You can access the platform on a desktop or on the Android/ iOS supported KuCoin mobile app. It maintains high-security measures. In addition to micro-withdrawal wallets and multifactor authentication, it also facilitates industry-level multilayer encryption and has internal risk control departments for maintaining overall safety.

Although there is no deposit fee, the blockchain transaction fee depends on cryptocurrencies. It also has varying withdrawal charges as per cryptocurrencies. It has active customer support working 24/ 7 and can be accessed on its website or via email and ticket system.

Facilitates trading of 200 cryptocurrencies 300 different pairing options Low trading fees 100x leverage Low withdrawal fees 24/ 7 customer support.

How we ranked the Best UK Ripple Trading Platforms.

Below are the key factors we considered while deciding the most promising platforms for Ripple Trading in the UK:

Trading Tools and Features.

For seasoned traders as well as beginners, trading tools and features can play a very important role in trading. To trade one crypto for another () XRP with ease, traders can use a variety of tools. Features like stop-loss orders and take-profit orders help you regulate both profits and losses while you trade XRP. Market research, experts’ analysis, charting tools are other important features of a solid trading platform. These will make your Ripple investment profit-worthy.

Some platforms also offer a demo account so that you can successfully test your trading skills before actually putting in real money. eToro offers tools like Copy Trading and CopyPortfolios, which are unique to its platform. While Copy Trading enables you to copy experienced and influential traders and mimic their moves, investing in the CopyPortfolio tool is also a great option.

Its social trading platform also helps you stay connected with the trading community and take ideas for your trading. eToro also offers a demo account with a preloaded paper trading balance of $100k.

Regulation & Safety.

Many exchanges that might claim to offer flawless trading experience may not be regulated. You must thus be careful while choosing a platform for your investment. Platforms that are regulated will protect users and the funds. Unregulated platforms may not have that edge. You are also liable to get the best conversion rate for fiat to digital currency conversion when a broker you are trading with is regulated.

eToro is a top name in this regard as it is regulated by the FCA, the ASIC (Australia), and CySEC (Cyprus). It thus makes sure that you trade with safety and ease. Regulated platforms will conduct a thorough KYC process and thereby are extremely reliable.

Fees & Commissions.

Fees and commissions are also vital for exchanges to create a reputation among traders. These include deposit fees, commissions, withdrawal fees among other charges. There are platforms like eToro that do not charge any commission on buying/ selling XRP. Platforms like Binance charges 0.10% commission on both buying and selling holdings.

There are spreads charged by trading platforms, which are a one-time charge for buying/ selling a trade. eToro’s average spreads are at 0.75%. Bybit offers a 0.025% maker rebate for limit orders in futures trading. Thus, these are significant indicators of whether a trading platform should be preferred by traders.

Sign-up FREE to receive our extended weekly market update and coin analysis report.

BTC trader Bitcoin-Trade-Robot _ Best cryptocurrency stocks for 2023 bityard.

An insurer may offer an ISA policy, on condition that the investor takes out a taxable policy of life insurance with a minimum premium of _10,000: with an allocation rate of 100 plus x%. paying a Many people use the money they borrow against the payout to help their children with house deposits, or to pay off students loans, whilst others use it to help fund their retirement, especially if their pension hasn't worked out to be as profitable as they'd once hoped. Whole life insurance offers many options, and flexibility with your Life insurance protects your family in the event of your death. For this reason, life insurance is also known as death insurance. The amount you can pay for cover depends on aspects of your health and lifestyle. With life insurance, you can use the tax-free lump sum payment to clear your debts (such as a mortgage, loan, or credit cards). Life insurance policy loans are not the same as other loans: Policy owners are not required to repay the loan. Keep in mind, the insurance company will charge interest on the policy loan. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. When you take out a policy loan, you're not removing money from the cash value of your account. Instead, you're taking a loan from the insurer and just using the cash Life insurance loans don't require credit checks or lengthy approval processes. The life insurance company already has the cash value of your policy as collateral. Instead, they set up the loan and designate an interest rate. You don't even have to make payments to repay the loan technically, but it's a good idea. The rules vary by insurer, but a person can usually borrow between 90% and 95% of the cash value of their life insurance policy. Loan funds typically arrive within one to 15 days. Since And while most life insurance with cash values allows for loans, there are terms. For example, you'll have to paying interest (often 5% or 8%) that accrues on loan. It may be your money in the Gemini maintains insurance coverage against certain types of losses for the crypto that we hold on your behalf in our online hot wallet subject to limitations. Please see the Digital Asset Insurance section of our User Agreement for more information. EARN Funds in Gemini Earn are not insured by Gemini. You can learn more here. FOR UK CUSTOMERS: A policy loan allows you to borrow money using your life insurance policy's cash value as collateral. You can use this money for anything. There aren't any restrictions. There isn't a set repayment schedule, and you aren't required to pay back this loan before you die. Any balance left when you pass away is subtracted from your policy HS320 Gains on UK life insurance policies (2022) Updated 6 April 2022. This helpsheet deals with chargeable event gains arising from UK life insurance policies. It covers the most common Pros. You can use the loan funds for whatever you choose. Money from an insurance policy loan is not taxed as income. It doesn't take very long to get access to your loan funds. Loans do not have Loan insurance is an insurance policy that safeguards the monthly payments of any loan that you have taken out. The policy provides you the peace of mind that should anything happen to your ability to work. For example, if you are made redundant, have an accident, or take off work due to illness, the policy will pay the monthly cost of your loan until you are able to return to work. However, if your estate plus your life insurance policy are worth more than that in total, inheritance tax will be due on anything above that threshold at 40%. This means tat if you leave a total of _400,000, the first _325,000 is tax free. The rest - _75,00 - will be taxed at 40%, leaving _45,000. Type of insurance * Life Insurance - The insured sum is paid out if you die during the term of the policy.

OPINION #1: Best cryptocurrency stocks for 2023 bityard.

Life Insurance with Critical Illness - As above but also pays out on diagnosis of certain medical conditions as laid out in the policy, i.e. heart attack, some cancers, stroke etc. Whole of Life - A plan that covers you for the rest of your life instead of a set term. A life insurance pay out refers to the sum of money received by a policyholder's beneficiaries upon their passing. After you've passed away your beneficiaries, or trustee will contact your insurer to make a claim. The insurer will then review the claim and a pay out will be issued if the claim is valid. In 2020, 97% of UK life insurance Q Is it possible to have a whole life insurance policy and use this to borrow against to buy a house, for example, a life Insurance policy to mature in 20 years' time with a sum assured of _ Life Insurance. Our life insurance is designed to support your family financially when you're no longer there for them. The cover will pay out after your death, or if you're diagnosed with a terminal illness. This can be a difficult thing to talk (or even think) about, but it really needs to get sorted. A policy loan also referred to as a life insurance loan is a loan that one takes against their life insurance policy. It is one of the sources from which you can get a loan the easiest. This is because a policy loan is taken against one's own assets thereby making the usual pre-credit hurdles such as credit checks with Credit Reference Life Insurance. Protection for your family should the worst happen. Plus, get a 15% discount if you're a Nationwide member. You're a Nationwide member if you hold a Nationwide mortgage, savings or current account. You'll also need to have got your quote on or after 23 June 2021. Our policy has always been to offer our customers personalised service with a professional touch. Geminia Insurance Limited. Le'Mac, 5th Floor. Church Road, Off Waiyaki Way. P.O Box 61316 00200 City Square,Nairobi. Tel: +254 20 278 2000. Fax: +254 20 278 2100. Email: info@geminia.co.ke | life@geminia.co.ke. Geminia Insurance Company Limited. Exclusive access to Legal & General Wellbeing Support Services. Up to 22,000 Nectar points † when you take out a Life Insurance or Decreasing Life insurance policy direct with us. The number of Nectar points you receive depends on your premium: If your monthly premium is under _8.50, we'll give you 10,000 points, which could be worth _50. At 5% to 7% interest per year, a life insurance loan is cheaper than most personal loans (the lowest EIR right now is 7%). Not only that, but life insurance loans give you a flexibility of repayment that personal loans cannot. By that, I mean that most personal loans require you to pay back a fixed amount monthly, and you will be penalised if Guaranteed life insurance helps you plan ahead for those you leave behind.

OPINION #2: Best cryptocurrency stocks for 2023 bityard.

Compare quotes for policies that could pay out a lump sum to take care of loved ones. Compare deals from trusted insurers. Tailor cover to your needs. Get a free quote in under 5 minutes. Life insurance. From just _5 a month - that's equivalent to around _1.16 a week. We paid out 99.4% of life insurance claims in 2021 1. Smarter healthcare with the Aviva DigiCare+ app. Guaranteed life insurance is a type of life insurance designed for over 50s. Like other life insurance policies, it provides a lump sum payment to the person of your choice when you die. However, unlike other forms of life insurance, it does not involve having a medical examination or answering lots of questions about your health - making it According to SunLife, the average cost of a UK funeral is now _4,417, whilst the total cost of dying is _9,493. This is a 130% increase over the past 16 years and shows no signs of slowing down. A significant cost which should be factored into the amount of life insurance you secure. _. Life Insurance Policy Loans - Best Insurances FAQs about Life Insurance Policy LoansHere are some financial situations when a life insurance loan might be a sensible ch…Because the money is already within the policy and immediately available, it's a …Don't let a life insurance policy lapse because you can't afford the payment. A loan c…Before paying a higher interest rate for a Fixed monthly premiums from _5, depending on your circumstances, so you can plan ahead - no surprises! No-one covers more families in the UK than us ** (based on new life insurance sales). We paid _478 million in life claims in 2021, that 97.9% of claims paid. Get a quote online in 2 minutes, you could be covered in just 15. Available at affordable interest rates of 10.50% to 12.75% per annum, you can get a maximum loan amount upto 85% of the total surrender value of your life insurance policy. The interest will be charged only on the utilized amount. Other than this, you will also get an ATM and Cheque Book facility on this. Here are some additional tips when taking out a policy loan: Monitor your loan balance regularly in comparison to your cash value. Formulate a disciplined loan repayment plan and make regular scheduled payments. Pay the interest on the loan every year to prevent your loan balance from increasing. The ability to take loans on your policy is a By law, life insurers must offer cash value life insurance policy owners ("Owners") the contractual right to take loans from their policies. By taking a policy loan, the Owner has a means of accessing policy cash values without having to surrender any death benefit. Policy loans are collateralized internally by the policy death benefit. Sheila has a life insurance policy with a $105,000 cash value, a $60,000 cost basis, and a $30,000 loan. In the event that Sheila surrenders the policy, her total gain for tax purposes will be $45,000, which is the difference between the $105,000 cash value and her $60,000 cost basis. Rs. 999 + GST. Bajaj Finance Ltd. offers a hassle-free loan against insurance, so you can get funds for financial emergencies by pledging your insurance policy as collateral. This ensures that you keep your insurance intact for emergencies while also raising funds for immediate use.

OPINION #3: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free. The $110,000 gain, however, would be taxed as ordinary income.

OPINION #4: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, copy trade cryptocurrency you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free. The $110,000 gain, however, would be taxed as ordinary income.

OPINION #5: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free. The $110,000 gain, however, would be taxed as ordinary income.

The $110,000 gain, however, would be taxed as ordinary income.

Scalping is one of the most profitable forms of crypto trading.

It involves cashing in quick, small, and consistent profits, letting the compounded interest work out in your favor. Trading bots for scalping are software designed to initiate short intraday trades that can last anywhere from a few minutes to several hours.

It involves cashing in quick, small, and consistent profits, letting the compounded interest work out in your favor. Trading bots for scalping are software designed to initiate short intraday trades that can last anywhere from a few minutes to several hours.If you're short on time and want to secure your gains in the crypto market, invest your money into the WunderFin platform. We'll give you up to $250 of free WUN tokens with our Referral Program, with no minimum investment required. You're guaranteed a good return on your money and the best crypto trading platform for scalping.

The key to long term investment success lies in the ability to create a properly diversified portfolio. The secret is to invest into the right asset classes and to ensure that you have the right distribution of risk in your portfolio.

Don't let the huge potential of compounding interest go to your head. You must stay disciplined and avoid the temptation to take all your gains now. Compound interest is a powerful force, but it can only take you so far. Discipline is what separates a successful investor from a portfolio of losses.

If you put these six proven small cap dividend stocks on your watchlist and reap the rewards of compound interest over time, your profitable portfolio will grow to a size that was only a distant dream before you started. Remember, the bigger your account grows, the greater your returns will be.

The chart below shows the compound interest earned and capital lost, on average, each year. The chart includes both interest earned and capital lost in the account balance. The capital lost includes the principal invested and all interest earned, as well as all dividends.

Discover how to begin a successful crypto trading strategy and begin making consistent profits today. Find out how to trade the crypto market at the right time and the right price with crypto trading strategies. Transform your investment into passive income today.

Best cryptocurrency stocks for 2023 bityard.

Fast Cash Oil-Profit _ Best cryptocurrency stocks for 2023 bityard.

Best Ripple Trading Platform in the UK.

Being among the top 10 cryptocurrencies by marketcap, Ripple (XRP) has high liquidity for trading and strong future potential growth. In this guide we review the best XRP trading platforms that accept UK and worldwide traders.

XRP is its native cryptocurrency of Ripple Labs, created to enable global payments. It has grown incredibly in market capitalization since its inception. It is sometimes referred to as just Ripple.

Technically Ripple refers to an XRP ledger, which is similar to the blockchain. It facilitates payments in XRP. Deriving its value from its digital payment network and protocol, it is a centralized platform, possesses global security and money transfer service. More than 100 companies have implemented Ripple’s software for smoother transactions.

All the Ripple coins that exist are pre-mined and there are around 45 billion XRP coins in circulation at the present. Ripple platform’s transactions are not limited to XRP but also facilitate fiat currencies like Dollars, Pound, Euro, etc, and other cryptocurrencies.

Best Places to Trade XRP in January 2023.

Copytrade winning investors.

XRP Trading Platforms in the UK – Top 5 List.

eToro – Best for copy trading others, and has solid regulation Binance – Best for a variety of altcoins Bybit – Best for day trading Kucoin – Best for small marketcap altcoins.

Best XRP Trading Platforms – Full Reviews.

eToro – Best Copy Trading Platform.

eToro stands out among the many crypto trading platforms on the market, and has listed XRP. As it is regulated by three institutions, it is also among the safest options available. The regulation licenses are from FCA, ASIC, and CySEC.

With 50+ popular cryptocurrencies listed for trading including XRP, eToro is a suitable platform for trading XRP. There are many pairs that eToro offers, enabling investors to leverage on the same. You can also benefit from crypto-to-crypto trades on eToro such as BTC/ XRP.

eToro offers outstanding tools like CopyPortfolios (also known as Smart Porfolios), enabling you to access a diversified range of digital currencies with solid portfolio management. The Copy Trading tool in eToro also allows you to copy the buys, sells and stop loss orders of expert traders.

The minimum deposit on the eToro platform is $10 for US and UK traders (about _7) and deposit methods include bank transfer, debit/ credit card transactions, e-wallets like Paypal, Skrill, etc.

Since many exchanges have suspended the markets for XRP, eToro remains one of your trusted platforms for trading XRP in the UK. It has an impressive customer support facility 24/ 5 available on chat, email, or on-call.

User-friendly, instant withdrawals Regulated by the FCA, ASIC, and CySEC Lower spreads compared to other platforms Offers crypto, stocks, indices, ETFs, and more Social trading, Copy trading and CopyPortfolio tools Supports fiat currency deposits Support debit / credit cards, Paypal, e-wallets.

2. Binance – Best Altcoin Exchange in UK.

Binance is another great option if you are looking for day trading Ripple.

It has the highest daily trading volumes and liquidity. It is known to offer a huge number of trading pairs such as XRP/ ETH, BTC/ ETH, etc. Binance also facilitates the trade of a wide array of Altcoins on its platform. The technically advanced tools and indicators on the platforms enable day traders to trade profitably with Ripple.

It has the highest daily trading volumes and liquidity. It is known to offer a huge number of trading pairs such as XRP/ ETH, BTC/ ETH, etc. Binance also facilitates the trade of a wide array of Altcoins on its platform. The technically advanced tools and indicators on the platforms enable day traders to trade profitably with Ripple.Binance exchange has outstanding security features to keep your crypto funds safe. The security process includes two-factor authentication, address whitelisting, email notifications, etc. Although it is an unregulated platform, it still ensures commendable safety and security. You can access the Binance platform on a desktop or use the iOS/ Android supported mobile wallet, and trading app.

The commission that the platform charges is 0.10% per trade. The KYC process is not required to make deposits using another cryptocurrency. It is mandatory only when you carry out bank transfers or debit/ credit card transactions for deposits. It has a charge of 3% for debit/ credit card transactions. eToro only charges 0.5% in this case. If you deposit funds by using a UK bank account, it is completely free.

Binance is known among traders for its sophisticated cryptocurrency instruments. You can go for copy traders crypto futures, options, and swaps. Unlike Bybit, it does not offer maker rebates in futures trading. If you use its custom cryptocurrency, BNB, or convert fiat currency to BNB, you get a discount. The platform offers 24/7 customer support on a ticket basis. It has options for retail and professional investor accounts.

Wide range of Altcoins Hundreds of pairs Advanced charting tools Customizable indicators on charts 0.10% trading fee Discount for using BNB Good security measures.

3. Bybit – Best Day Trading Platform.

Another reliable platform for trading Ripple in the UK is Bybit. The Dual Price Mechanism on Bybit exchange protects traders from trade/ price manipulation and helps in preventing losses. Traders can set stop-loss and derive profit at the same time when they go for a limit order. With sophisticated trading features, this platform offers up to 100x leverage.

With the leverage option, traders can opt for how to copy crypto traders a higher value without actually holding that amount. When you trade with "leveraging", you basically borrow from the platform to increase your bet. 100x leverage is an attractive feature, especially for experienced traders. By leveraging your trade with 100x, you have the potential of earning huge profits. In the case of high volatility, the feature will also incur losses even with a slight price dip. Hence, using such features demands caution.

Bybit comes with an in-built Tradingview, which has remarkable indicators so that you can engage in trading Ripple profitably. There are no charges for funding and it stands out as a platform that offers a 0.025% maker rebate for limit orders in futures trading. You can also go for quarterly futures contracts trading. With this feature, traders are able to use a calendar cycle to set contracts’ expiry, which adds up to the spot price.

Bybit does not directly handle fiat deposits. Users are able to deposit by using another cryptocurrency for trading. It has a 0.075% taker fee per order for futures trading and a 0.025% maker rebate. With a 0.10% trading fee for spot trading it is a competitive platform in terms of charges. Bybit XRP withdrawal charges are 0.25 XRP per withdrawal and the minimum withdrawal is 20 XRP.

You can access the Bybit platform on a desktop or its app supported on IOS and Android systems.

No KYC needed Up to 100x leverage Spot and contracts trading Enables quarterly futures contracts trading Maker rebate for trading contracts Available as a mobile app Multiple order types supported Reduced risk of liquidations.

4. KuCoin – Best Low Marketcap Altcoin Exchange.

KuCoin can be used conveniently for trading Ripple in the UK. By supporting around 200 cryptocurrencies, it is a preferred name among investors.

Being in the highly competitive crypto market, this relatively new crypto exchange enables futures and margin trading with up to 100x leverage. It is known in the market for having a well-structured trading platform. It offers a high volume of liquidity. The number of assets and services on this platform is huge and it is now a highly opted platform among seasoned crypto traders.

Many investors who are seeking a variety in terms of coins go for KuCoin. If you trade Ripple on this platform, you can hugely benefit from more than 300 different trading pairs that it offers.

Buying XRP on the platform is possible with P2P fiat trade, credit/ debit cards via Simplex, PayMIR, Banxa, etc. If you want to trade small market-cap coins apart from your Ripple investment, then this is the best platform available for you. It also offers bonuses and discounts.

KuCoin has a 0.1% charge per trade. The charges are relatively lower for futures trading. You can access the platform on a desktop or on the Android/ iOS supported KuCoin mobile app. It maintains high-security measures. In addition to micro-withdrawal wallets and multifactor authentication, it also facilitates industry-level multilayer encryption and has internal risk control departments for maintaining overall safety.

Although there is no deposit fee, the blockchain transaction fee depends on cryptocurrencies. It also has varying withdrawal charges as per cryptocurrencies. It has active customer support working 24/ 7 and can be accessed on its website or via email and ticket system.

Facilitates trading of 200 cryptocurrencies 300 different pairing options Low trading fees 100x leverage Low withdrawal fees 24/ 7 customer support.

How we ranked the Best UK Ripple Trading Platforms.

Below are the key factors we considered while deciding the most promising platforms for Ripple Trading in the UK:

Trading Tools and Features.

For seasoned traders as well as beginners, trading tools and features can play a very important role in trading. To trade one crypto for another () XRP with ease, traders can use a variety of tools. Features like stop-loss orders and take-profit orders help you regulate both profits and losses while you trade XRP. Market research, experts’ analysis, charting tools are other important features of a solid trading platform. These will make your Ripple investment profit-worthy.

Some platforms also offer a demo account so that you can successfully test your trading skills before actually putting in real money. eToro offers tools like Copy Trading and CopyPortfolios, which are unique to its platform. While Copy Trading enables you to copy experienced and influential traders and mimic their moves, investing in the CopyPortfolio tool is also a great option.

Its social trading platform also helps you stay connected with the trading community and take ideas for your trading. eToro also offers a demo account with a preloaded paper trading balance of $100k.

Regulation & Safety.

Many exchanges that might claim to offer flawless trading experience may not be regulated. You must thus be careful while choosing a platform for your investment. Platforms that are regulated will protect users and the funds. Unregulated platforms may not have that edge. You are also liable to get the best conversion rate for fiat to digital currency conversion when a broker you are trading with is regulated.

eToro is a top name in this regard as it is regulated by the FCA, the ASIC (Australia), and CySEC (Cyprus). It thus makes sure that you trade with safety and ease. Regulated platforms will conduct a thorough KYC process and thereby are extremely reliable.

Fees & Commissions.

Fees and commissions are also vital for exchanges to create a reputation among traders. These include deposit fees, commissions, withdrawal fees among other charges. There are platforms like eToro that do not charge any commission on buying/ selling XRP. Platforms like Binance charges 0.10% commission on both buying and selling holdings.

There are spreads charged by trading platforms, which are a one-time charge for buying/ selling a trade. eToro’s average spreads are at 0.75%. Bybit offers a 0.025% maker rebate for limit orders in futures trading. Thus, these are significant indicators of whether a trading platform should be preferred by traders.

Sign-up FREE to receive our extended weekly market update and coin analysis report.

BTC trader Bitcoin-Trade-Robot _ Best cryptocurrency stocks for 2023 bityard.

An insurer may offer an ISA policy, on condition that the investor takes out a taxable policy of life insurance with a minimum premium of _10,000: with an allocation rate of 100 plus x%. paying a Many people use the money they borrow against the payout to help their children with house deposits, or to pay off students loans, whilst others use it to help fund their retirement, especially if their pension hasn't worked out to be as profitable as they'd once hoped. Whole life insurance offers many options, and flexibility with your Life insurance protects your family in the event of your death. For this reason, life insurance is also known as death insurance. The amount you can pay for cover depends on aspects of your health and lifestyle. With life insurance, you can use the tax-free lump sum payment to clear your debts (such as a mortgage, loan, or credit cards). Life insurance policy loans are not the same as other loans: Policy owners are not required to repay the loan. Keep in mind, the insurance company will charge interest on the policy loan. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. When you take out a policy loan, you're not removing money from the cash value of your account. Instead, you're taking a loan from the insurer and just using the cash Life insurance loans don't require credit checks or lengthy approval processes. The life insurance company already has the cash value of your policy as collateral. Instead, they set up the loan and designate an interest rate. You don't even have to make payments to repay the loan technically, but it's a good idea. The rules vary by insurer, but a person can usually borrow between 90% and 95% of the cash value of their life insurance policy. Loan funds typically arrive within one to 15 days. Since And while most life insurance with cash values allows for loans, there are terms. For example, you'll have to paying interest (often 5% or 8%) that accrues on loan. It may be your money in the Gemini maintains insurance coverage against certain types of losses for the crypto that we hold on your behalf in our online hot wallet subject to limitations. Please see the Digital Asset Insurance section of our User Agreement for more information. EARN Funds in Gemini Earn are not insured by Gemini. You can learn more here. FOR UK CUSTOMERS: A policy loan allows you to borrow money using your life insurance policy's cash value as collateral. You can use this money for anything. There aren't any restrictions. There isn't a set repayment schedule, and you aren't required to pay back this loan before you die. Any balance left when you pass away is subtracted from your policy HS320 Gains on UK life insurance policies (2022) Updated 6 April 2022. This helpsheet deals with chargeable event gains arising from UK life insurance policies. It covers the most common Pros. You can use the loan funds for whatever you choose. Money from an insurance policy loan is not taxed as income. It doesn't take very long to get access to your loan funds. Loans do not have Loan insurance is an insurance policy that safeguards the monthly payments of any loan that you have taken out. The policy provides you the peace of mind that should anything happen to your ability to work. For example, if you are made redundant, have an accident, or take off work due to illness, the policy will pay the monthly cost of your loan until you are able to return to work. However, if your estate plus your life insurance policy are worth more than that in total, inheritance tax will be due on anything above that threshold at 40%. This means tat if you leave a total of _400,000, the first _325,000 is tax free. The rest - _75,00 - will be taxed at 40%, leaving _45,000. Type of insurance * Life Insurance - The insured sum is paid out if you die during the term of the policy.

OPINION #1: Best cryptocurrency stocks for 2023 bityard.

Life Insurance with Critical Illness - As above but also pays out on diagnosis of certain medical conditions as laid out in the policy, i.e. heart attack, some cancers, stroke etc. Whole of Life - A plan that covers you for the rest of your life instead of a set term. A life insurance pay out refers to the sum of money received by a policyholder's beneficiaries upon their passing. After you've passed away your beneficiaries, or trustee will contact your insurer to make a claim. The insurer will then review the claim and a pay out will be issued if the claim is valid. In 2020, 97% of UK life insurance Q Is it possible to have a whole life insurance policy and use this to borrow against to buy a house, for example, a life Insurance policy to mature in 20 years' time with a sum assured of _ Life Insurance. Our life insurance is designed to support your family financially when you're no longer there for them. The cover will pay out after your death, or if you're diagnosed with a terminal illness. This can be a difficult thing to talk (or even think) about, but it really needs to get sorted. A policy loan also referred to as a life insurance loan is a loan that one takes against their life insurance policy. It is one of the sources from which you can get a loan the easiest. This is because a policy loan is taken against one's own assets thereby making the usual pre-credit hurdles such as credit checks with Credit Reference Life Insurance. Protection for your family should the worst happen. Plus, get a 15% discount if you're a Nationwide member. You're a Nationwide member if you hold a Nationwide mortgage, savings or current account. You'll also need to have got your quote on or after 23 June 2021. Our policy has always been to offer our customers personalised service with a professional touch. Geminia Insurance Limited. Le'Mac, 5th Floor. Church Road, Off Waiyaki Way. P.O Box 61316 00200 City Square,Nairobi. Tel: +254 20 278 2000. Fax: +254 20 278 2100. Email: info@geminia.co.ke | life@geminia.co.ke. Geminia Insurance Company Limited. Exclusive access to Legal & General Wellbeing Support Services. Up to 22,000 Nectar points † when you take out a Life Insurance or Decreasing Life insurance policy direct with us. The number of Nectar points you receive depends on your premium: If your monthly premium is under _8.50, we'll give you 10,000 points, which could be worth _50. At 5% to 7% interest per year, a life insurance loan is cheaper than most personal loans (the lowest EIR right now is 7%). Not only that, but life insurance loans give you a flexibility of repayment that personal loans cannot. By that, I mean that most personal loans require you to pay back a fixed amount monthly, and you will be penalised if Guaranteed life insurance helps you plan ahead for those you leave behind.

OPINION #2: Best cryptocurrency stocks for 2023 bityard.

Compare quotes for policies that could pay out a lump sum to take care of loved ones. Compare deals from trusted insurers. Tailor cover to your needs. Get a free quote in under 5 minutes. Life insurance. From just _5 a month - that's equivalent to around _1.16 a week. We paid out 99.4% of life insurance claims in 2021 1. Smarter healthcare with the Aviva DigiCare+ app. Guaranteed life insurance is a type of life insurance designed for over 50s. Like other life insurance policies, it provides a lump sum payment to the person of your choice when you die. However, unlike other forms of life insurance, it does not involve having a medical examination or answering lots of questions about your health - making it According to SunLife, the average cost of a UK funeral is now _4,417, whilst the total cost of dying is _9,493. This is a 130% increase over the past 16 years and shows no signs of slowing down. A significant cost which should be factored into the amount of life insurance you secure. _. Life Insurance Policy Loans - Best Insurances FAQs about Life Insurance Policy LoansHere are some financial situations when a life insurance loan might be a sensible ch…Because the money is already within the policy and immediately available, it's a …Don't let a life insurance policy lapse because you can't afford the payment. A loan c…Before paying a higher interest rate for a Fixed monthly premiums from _5, depending on your circumstances, so you can plan ahead - no surprises! No-one covers more families in the UK than us ** (based on new life insurance sales). We paid _478 million in life claims in 2021, that 97.9% of claims paid. Get a quote online in 2 minutes, you could be covered in just 15. Available at affordable interest rates of 10.50% to 12.75% per annum, you can get a maximum loan amount upto 85% of the total surrender value of your life insurance policy. The interest will be charged only on the utilized amount. Other than this, you will also get an ATM and Cheque Book facility on this. Here are some additional tips when taking out a policy loan: Monitor your loan balance regularly in comparison to your cash value. Formulate a disciplined loan repayment plan and make regular scheduled payments. Pay the interest on the loan every year to prevent your loan balance from increasing. The ability to take loans on your policy is a By law, life insurers must offer cash value life insurance policy owners ("Owners") the contractual right to take loans from their policies. By taking a policy loan, the Owner has a means of accessing policy cash values without having to surrender any death benefit. Policy loans are collateralized internally by the policy death benefit. Sheila has a life insurance policy with a $105,000 cash value, a $60,000 cost basis, and a $30,000 loan. In the event that Sheila surrenders the policy, her total gain for tax purposes will be $45,000, which is the difference between the $105,000 cash value and her $60,000 cost basis. Rs. 999 + GST. Bajaj Finance Ltd. offers a hassle-free loan against insurance, so you can get funds for financial emergencies by pledging your insurance policy as collateral. This ensures that you keep your insurance intact for emergencies while also raising funds for immediate use.

OPINION #3: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free. The $110,000 gain, however, would be taxed as ordinary income.

OPINION #4: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, copy trade cryptocurrency you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free. The $110,000 gain, however, would be taxed as ordinary income.

OPINION #5: Best cryptocurrency stocks for 2023 bityard.

You can get up to Rs. 25 crore and finance your multiple Form to be filled out by policyowner/insured, and their doctor(s) to apply for waiver of premium payments on policies with the disability waiver of premium option. Download Form For all other forms, please contact a customer service representative at 800-638-5000. The requirements of life insurance policies which policy loans can be taken out are as follows: Policy status must be effective and have a cash value of more than 1000 baht (after deducting debt and interest). The expiration date of the policy contract is more than 1 month. The policy must not be in the period of policy benefit payout. Life insurers fall into one of two possible categories for when and how they charge interest on a life insurance policy loan. The two categories are 1.) in advance or 2.) in arrears. Charging interest in advance means the life insurer will charge all of the interest assumed due for the year when the loan originates and will do so again at the Many whole life insurance contracts build cash value. A valuable feature of a cash value life insurance policy is the ability to borrow from your policy's cash value. However, taking out a policy loan can have a significant impact on your policy's performance. In addition, any outstanding loan balance and interest will reduce proceeds But borrowing against your policy to pay off your $10,000 would allow you: To earn $1,452.73 over the next five years in the policy. While paying 5% interest to the company, or $1,548.74 of interest over 5 years. The $1,452.73 of policy growth is yours to keep. Every life insurance policy contains numerous provisions that it's important for Fortune 500 employees and retirees to be informed about. Most states have laws requiring certain provisions to be included in life insurance policies and prohibiting the inclusion of other provisions. Examples of provisions commonly required by law are the free Get started with Custody. $200 Million in insurance coverage for certain types of losses. Same day withdrawals and instant liquidity for trading on Gemini Exchange. Custom-built by technical experts in cryptography, finance, and security. Dedicated account representatives and 24/7 expert customer support. Pros of life insurance loans. If you're in a pinch and you need extra cash to cover expenses, life insurance loans have several advantages, including: No additional requirements: Borrowing money from a life insurance policy doesn't require you to undergo a credit check, employment verification, or meet minimum income requirements. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. It is sometimes called "pure life insurance" because unlike the permanent policy or whole life insurance, there's no cash value component to the policy - once the term is over, there's nothing left. Term life insurance. This coverage lasts for a limited time, typically 10, 15, 20, or 30 years. It's very easy to get a quote and buy term coverage, and it's also typically more affordable than permanent whole or universal life insurance. However, when your term ends, you're no longer protected - you either have to apply for a new policy at a Policy loan is a loan program which you can avail from your GSIS life insurance policy. There are two kinds of compulsory GSIS life insurance programs which are automatically granted to you the day you enter government service: the Enhanced Life Policy (ELP) and the Life Endowment Policy (LEP). ELP provides cover for you if you entered the service after July 31, 2003. Joint life insurance is a type of life insurance for two people where both are covered under a single policy. Joint life comes in two varieties: first-to-die, which pays out to the surviving If you were to surrender your policy and walk away with the cash value, you would recover the $90,000 you paid in, tax-free.

The $110,000 gain, however, would be taxed as ordinary income.

The $110,000 gain, however, would be taxed as ordinary income.

Уважаемый посетитель, Вы зашли на сайт kopirki.net как незарегистрированный пользователь.

Мы рекомендуем Вам зарегистрироваться либо войти на сайт под своим именем.

Мы рекомендуем Вам зарегистрироваться либо войти на сайт под своим именем.

Просмотров: 33

Просмотров: 33  Комментариев: (0)

Комментариев: (0)