Популярные статьи

Реклама

Обратная связь

Яндекс Апдейт

Сервис не доступен

Оцените работу движка

Кто онлайн

Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Yandex Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Гость Всего: 148

У нас искали

Based On The FCRA's Provisions, You Can Retrieve And Dispute Any Negative Information On Your Report

Most of us make payments at the end of the month -- from telephone to utilities and lines of credit. Fundamentally, loan issuers would come for their money in case you don't make payments on time. Each collection adds to your credit report and can cripple your loan negotiation capability. Based on FICO, outstanding collections will affect one more than paid groups. Your score will fall based on some variables whether one of your account goes into collection. The impact of a collection on someone with a very low score isn't as intense as in somebody with a high score. Missing a payment would make your loan score report it as"late payment" into the three bureaus. In case you don't restore your account from its bad condition, you can experience a collection. When your account goes into collection, you will immediately see your credit score dropping. To prevent collections, you ought to make timely payments and keep good financial habits.

Your credit report entails your current financial situation and debt quantity. The main eligibility criteria for a standard checking account are good credit history. If that is not the situation, you may have to go to get a checking account for bad credit. In the event that you already had a checking account with a bank, then its trades would have no effect on you. An overdraft won't appear on your report if you don't fail to make timely payments. On the other hand, the overdraft might appear if the bank turns the sum to a set. Therefore, there are limited circumstances when a checking account may damage your credit rating. Some financial institutions can perform a gentle inquiry when submitting an application for a checking account. If you sign up for overdraft protection, then a checking account can affect your score.

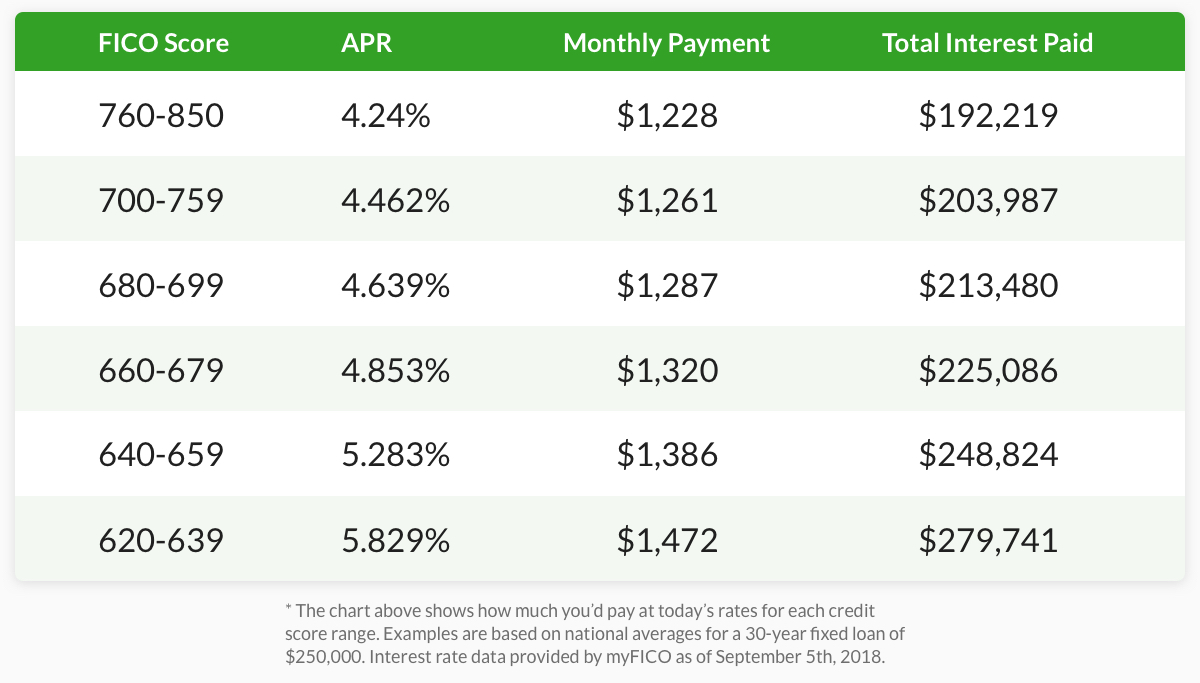

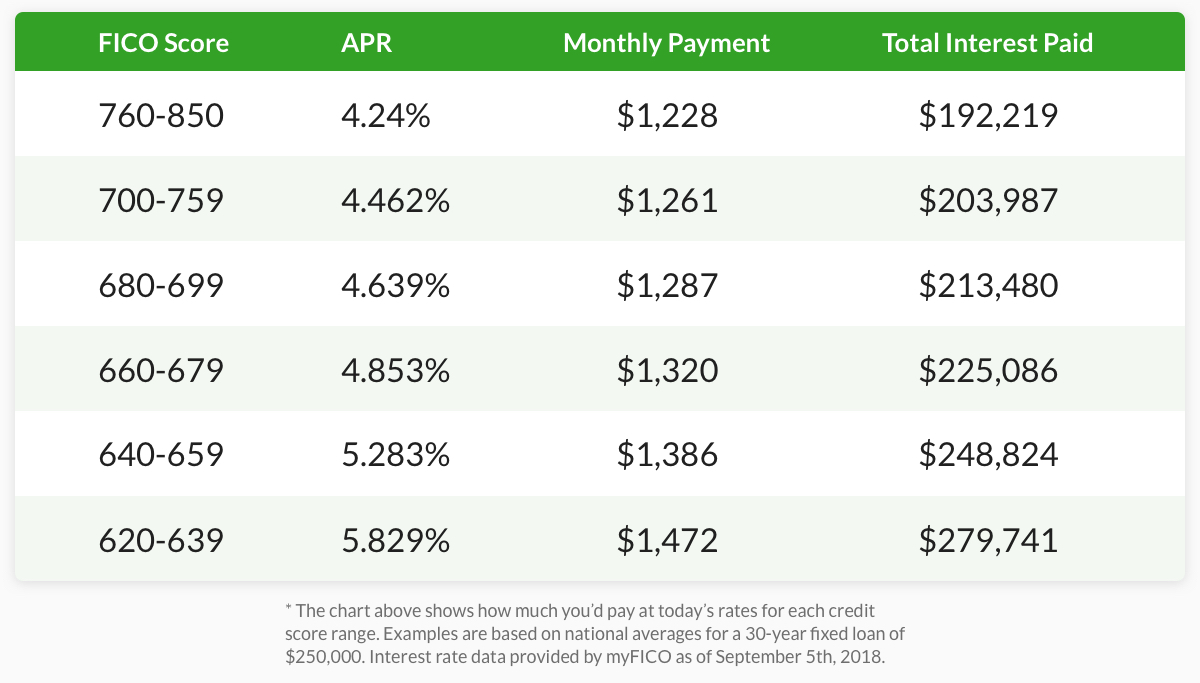

Your credit rating is a credit snapshot by which lenders use to judge your creditworthiness. Different lending businesses use tailored approaches to look at credit scores for a variety of consumers. Besides, they use this version because different credit card companies have different credit score models. Loan issuers might give someone using a high score an upper hand in contrast to one using a low score. If your application becomes powerful, you're incur expensive interest rates and charges. It's imperative to watch your finances to prevent damaging your credit score and report. Assessing your credit score regularly would provide you a very clear overview of your financial well-being. Since the 3 data centers give consumers a free credit report per year, you should optimize it. Retrieve your account and inspect the elements that could damage your credit report. Before focusing on complicated products, start by working on straightforward elements. Since many credit repair businesses offer closely-similar services, choose the one that suits you. Always make sure you maintain good financial habits and assess your report regularly.

Consumers' desire for failure and loans to meet their obligations brought about bankruptcies. While it may help you avoid debt, you need to understand the long term consequences. Bankruptcies offer a short-term loan relief, but its consequences can go as much as a decade. Besides, a bankruptcy would diminish your success rate of negotiating for favorable interest prices. When filing for bankruptcy, you're encounter countless challenges and legal complexities. You'll want to show your inability to cover the loan and undergo credit counseling beforehand. Afterward, the entity would make you choose between chapter 7 or chapter 13 bankruptcy. Whichever the bankruptcy, you're pay the court fees and attorney fees. Since you'll lose a whole lot more than you gain, averting filing for bankruptcy is an ideal choice. Moreover, a bankruptcy tanks that your credit score and paints you as not creditworthy.

Prospective lenders don't check your entire credit report; they use your score to judge you. Different lending companies use tailored approaches to look at credit scores for various consumers. Besides, they use this version because different credit card companies have different credit rating models. If you have bad credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. It is crucial to see your finances to avoid damaging your credit report and score. You can track your score to give you a comprehensive summary of your credit. Considering that the 3 agencies give free reports to consumers each year, you need to use it to your leverage. Retrieve your account and inspect the elements that could hurt your . Start by removing the easy items before engaging in the ones that require legal care. There are many repair companies; hence you ought to choose your desired one sensibly. Ideally, checking your credit report regularly would help you handle your finances well.

Prospective lenders don't check your entire credit report; they use your score to judge you. Different lending companies use tailored approaches to look at credit scores for various consumers. Besides, they use this version because different credit card companies have different credit rating models. If you have bad credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. It is crucial to see your finances to avoid damaging your credit report and score. You can track your score to give you a comprehensive summary of your credit. Considering that the 3 agencies give free reports to consumers each year, you need to use it to your leverage. Retrieve your account and inspect the elements that could hurt your . Start by removing the easy items before engaging in the ones that require legal care. There are many repair companies; hence you ought to choose your desired one sensibly. Ideally, checking your credit report regularly would help you handle your finances well.

In the event you adored this informative article in addition to you would want to acquire more information relating to kindly pay a visit to our own web page. If you have had a poor credit history, you could find another opportunity to have a checking account. Typically, second opportunity accounts are intended to help individuals whose programs have flopped. Before approving the application, the financial institution refers to the ChexSystems database. ChexSystems is a thing to which banks report bad credit behavior. If your records are in this database, then this means that your credit history isn't comprehensive. Appearing about the ChexSystems database ensures your chances of success are incredibly low. A few credit unions and banks provide second chance accounts that will assist you rebuild a fantastic report. That stated, there is a difference between a standard checking account and the next chance type. Certainly, second chance checking account have benefits and disadvantages. While it's possible to use second chance checking accounts to reconstruct credit, they typically have high fees. Additionally, there is not any provision for an overdraft program in another chance checking accounts. Although it has some challenges, this checking account has an edge over secured credit cards.

Your credit report entails your current financial situation and debt quantity. The main eligibility criteria for a standard checking account are good credit history. If that is not the situation, you may have to go to get a checking account for bad credit. In the event that you already had a checking account with a bank, then its trades would have no effect on you. An overdraft won't appear on your report if you don't fail to make timely payments. On the other hand, the overdraft might appear if the bank turns the sum to a set. Therefore, there are limited circumstances when a checking account may damage your credit rating. Some financial institutions can perform a gentle inquiry when submitting an application for a checking account. If you sign up for overdraft protection, then a checking account can affect your score.

Your credit rating is a credit snapshot by which lenders use to judge your creditworthiness. Different lending businesses use tailored approaches to look at credit scores for a variety of consumers. Besides, they use this version because different credit card companies have different credit score models. Loan issuers might give someone using a high score an upper hand in contrast to one using a low score. If your application becomes powerful, you're incur expensive interest rates and charges. It's imperative to watch your finances to prevent damaging your credit score and report. Assessing your credit score regularly would provide you a very clear overview of your financial well-being. Since the 3 data centers give consumers a free credit report per year, you should optimize it. Retrieve your account and inspect the elements that could damage your credit report. Before focusing on complicated products, start by working on straightforward elements. Since many credit repair businesses offer closely-similar services, choose the one that suits you. Always make sure you maintain good financial habits and assess your report regularly.

Consumers' desire for failure and loans to meet their obligations brought about bankruptcies. While it may help you avoid debt, you need to understand the long term consequences. Bankruptcies offer a short-term loan relief, but its consequences can go as much as a decade. Besides, a bankruptcy would diminish your success rate of negotiating for favorable interest prices. When filing for bankruptcy, you're encounter countless challenges and legal complexities. You'll want to show your inability to cover the loan and undergo credit counseling beforehand. Afterward, the entity would make you choose between chapter 7 or chapter 13 bankruptcy. Whichever the bankruptcy, you're pay the court fees and attorney fees. Since you'll lose a whole lot more than you gain, averting filing for bankruptcy is an ideal choice. Moreover, a bankruptcy tanks that your credit score and paints you as not creditworthy.

Prospective lenders don't check your entire credit report; they use your score to judge you. Different lending companies use tailored approaches to look at credit scores for various consumers. Besides, they use this version because different credit card companies have different credit rating models. If you have bad credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. It is crucial to see your finances to avoid damaging your credit report and score. You can track your score to give you a comprehensive summary of your credit. Considering that the 3 agencies give free reports to consumers each year, you need to use it to your leverage. Retrieve your account and inspect the elements that could hurt your . Start by removing the easy items before engaging in the ones that require legal care. There are many repair companies; hence you ought to choose your desired one sensibly. Ideally, checking your credit report regularly would help you handle your finances well.

Prospective lenders don't check your entire credit report; they use your score to judge you. Different lending companies use tailored approaches to look at credit scores for various consumers. Besides, they use this version because different credit card companies have different credit rating models. If you have bad credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. It is crucial to see your finances to avoid damaging your credit report and score. You can track your score to give you a comprehensive summary of your credit. Considering that the 3 agencies give free reports to consumers each year, you need to use it to your leverage. Retrieve your account and inspect the elements that could hurt your . Start by removing the easy items before engaging in the ones that require legal care. There are many repair companies; hence you ought to choose your desired one sensibly. Ideally, checking your credit report regularly would help you handle your finances well.In the event you adored this informative article in addition to you would want to acquire more information relating to kindly pay a visit to our own web page. If you have had a poor credit history, you could find another opportunity to have a checking account. Typically, second opportunity accounts are intended to help individuals whose programs have flopped. Before approving the application, the financial institution refers to the ChexSystems database. ChexSystems is a thing to which banks report bad credit behavior. If your records are in this database, then this means that your credit history isn't comprehensive. Appearing about the ChexSystems database ensures your chances of success are incredibly low. A few credit unions and banks provide second chance accounts that will assist you rebuild a fantastic report. That stated, there is a difference between a standard checking account and the next chance type. Certainly, second chance checking account have benefits and disadvantages. While it's possible to use second chance checking accounts to reconstruct credit, they typically have high fees. Additionally, there is not any provision for an overdraft program in another chance checking accounts. Although it has some challenges, this checking account has an edge over secured credit cards.

Уважаемый посетитель, Вы зашли на сайт kopirki.net как незарегистрированный пользователь.

Мы рекомендуем Вам зарегистрироваться либо войти на сайт под своим именем.

Мы рекомендуем Вам зарегистрироваться либо войти на сайт под своим именем.

Просмотров: 14

Просмотров: 14  Комментариев: (0)

Комментариев: (0)